This notebook contains an example for how to use the taxbrain python package

# # Install conda, taxbrain, and taxcalc if in Google Colab.

import sys

if 'google.colab' in sys.modules and 'taxbrain' not in sys.modules:

# Install taxbrain and dependencies

!pip install taxbrain &> /dev/null

!pip install taxcalc &> /dev/null

!pip install pypandoc &> /dev/null

!pip install -U pandas &> /dev/null # make sure pandas is up to date

from taxbrain import TaxBrain, differences_plot, distribution_plot

reform_url = "https://raw.githubusercontent.com/PSLmodels/Tax-Calculator/master/taxcalc/reforms/Larson2019.json"

start_year = 2021

end_year = 2030

Static Reform#

After importing the TaxBrain class from the taxbrain package, we initiate an instance of the class by specifying the start and end year of the anlaysis, which microdata to use, and a policy reform. Additional arguments can be used to specify econoimc assumptions and individual behavioral elasticites.

Once the class has been initiated, the run() method will handle executing each model

tb_static = TaxBrain(start_year, end_year, microdata="CPS", reform=reform_url)

tb_static.run()

Once the calculators have been run, you can produce a number of tables, including a weighted total of a given variable each year under both current law and the user reform.

print("Combined Tax Liability Over the Budget Window")

tb_static.weighted_totals("combined")

Combined Tax Liability Over the Budget Window

| 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Base | 2.269723e+12 | 3.065057e+12 | 3.187451e+12 | 3.430286e+12 | 3.558234e+12 | 3.749566e+12 | 3.923694e+12 | 4.101939e+12 | 4.316249e+12 | 4.541999e+12 |

| Reform | 2.326814e+12 | 3.143256e+12 | 3.282028e+12 | 3.545953e+12 | 3.699010e+12 | 3.912748e+12 | 4.109452e+12 | 4.311587e+12 | 4.533253e+12 | 4.770344e+12 |

| Difference | 5.709077e+10 | 7.819926e+10 | 9.457664e+10 | 1.156674e+11 | 1.407758e+11 | 1.631815e+11 | 1.857588e+11 | 2.096474e+11 | 2.170046e+11 | 2.283448e+11 |

If you are interested in a detailed look on the reform’s effect, you can produce a differences table for a given year.

print("Differences Table")

tb_static.differences_table(start_year, "weighted_deciles", "combined")

Differences Table

| count | tax_cut | perc_cut | tax_inc | perc_inc | mean | tot_change | share_of_change | ubi | benefit_cost_total | benefit_value_total | pc_aftertaxinc | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0-10n | 0.102049 | 0.000000 | 0.000000 | 0.035165 | 34.458500 | 8.218450 | 0.000839 | 0.001469 | 0.0 | 0.0 | 0.0 | 0.006305 |

| 0-10z | 8.390748 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.0 | 0.0 | 0.0 | 0.000000 |

| 0-10p | 12.213889 | 0.000000 | 0.000000 | 5.510201 | 45.114223 | 3.693099 | 0.045107 | 0.079009 | 0.0 | 0.0 | 0.0 | -0.030271 |

| 10-20 | 20.708304 | 0.000000 | 0.000000 | 15.031974 | 72.589110 | 17.199769 | 0.356178 | 0.623880 | 0.0 | 0.0 | 0.0 | -0.049703 |

| 20-30 | 20.707505 | 0.019010 | 0.091801 | 13.230015 | 63.889952 | 27.007242 | 0.559253 | 0.979585 | 0.0 | 0.0 | 0.0 | -0.047437 |

| 30-40 | 20.706950 | 0.259493 | 1.253170 | 11.850040 | 57.227357 | 29.341194 | 0.607567 | 1.064212 | 0.0 | 0.0 | 0.0 | -0.036801 |

| 40-50 | 20.706181 | 1.020739 | 4.929636 | 12.904516 | 62.322051 | 27.887624 | 0.577446 | 1.011453 | 0.0 | 0.0 | 0.0 | -0.014320 |

| 50-60 | 20.708634 | 2.983512 | 14.407092 | 12.853635 | 62.068967 | -36.541184 | -0.756718 | -1.325465 | 0.0 | 0.0 | 0.0 | 0.110734 |

| 60-70 | 20.707540 | 3.810788 | 18.402900 | 12.691879 | 61.291099 | -155.091891 | -3.211572 | -5.625378 | 0.0 | 0.0 | 0.0 | 0.261506 |

| 70-80 | 20.705701 | 4.042144 | 19.521890 | 13.340665 | 64.429912 | -198.758187 | -4.115428 | -7.208569 | 0.0 | 0.0 | 0.0 | 0.271550 |

| 80-90 | 20.709850 | 4.418265 | 21.334121 | 14.297969 | 69.039464 | -427.711584 | -8.857843 | -15.515367 | 0.0 | 0.0 | 0.0 | 0.416827 |

| 90-100 | 20.708024 | 1.431391 | 6.912254 | 17.352383 | 83.795459 | 3471.405278 | 71.885943 | 125.915170 | 0.0 | 0.0 | 0.0 | -1.292652 |

| ALL | 207.075375 | 17.985342 | 8.685408 | 129.098443 | 62.343696 | 275.700439 | 57.090772 | 100.000000 | 0.0 | 0.0 | 0.0 | -0.321387 |

| 90-95 | 10.354203 | 1.292340 | 12.481311 | 8.241434 | 79.595059 | -298.772462 | -3.093551 | -5.418653 | 0.0 | 0.0 | 0.0 | 0.256932 |

| 95-99 | 8.282277 | 0.139051 | 1.678898 | 7.283324 | 87.938673 | 318.774347 | 2.640177 | 4.624526 | 0.0 | 0.0 | 0.0 | -0.070544 |

| Top 1% | 2.071544 | 0.000000 | 0.000000 | 1.827625 | 88.225265 | 34920.477840 | 72.339316 | 126.709297 | 0.0 | 0.0 | 0.0 | -4.338101 |

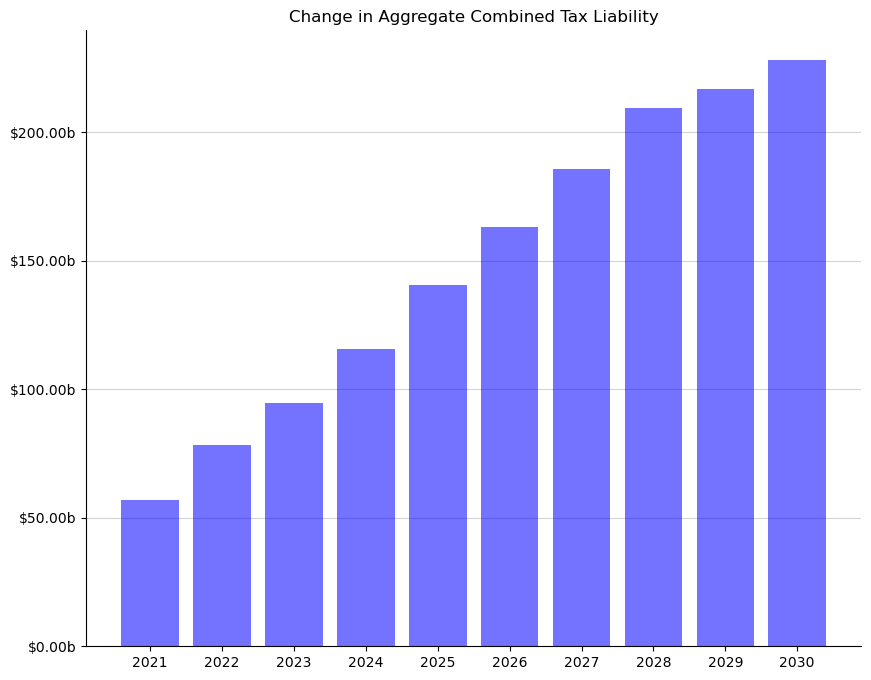

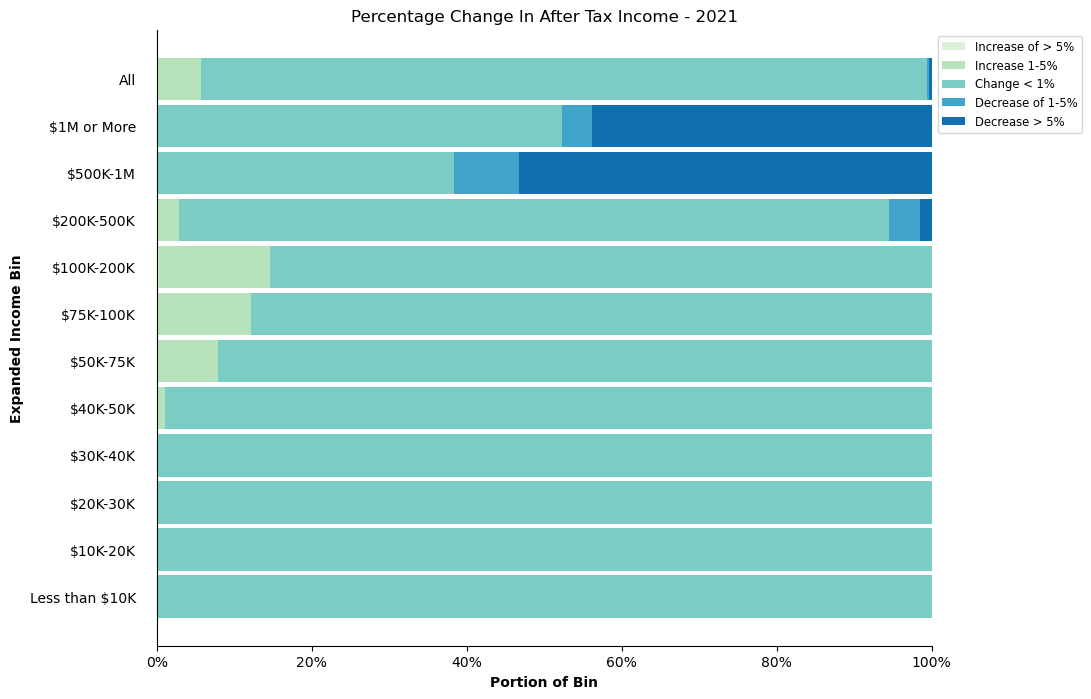

TaxBrain comes with two (and counting) built in plots as well

differences_plot(tb_static, 'combined', figsize=(10, 8));

distribution_plot(tb_static, 2021, figsize=(10, 8));

You can run a partial-equlibrium dynamic simulation by initiating the TaxBrian instance exactly as you would for the static reform, but with your behavioral assumptions specified

tb_dynamic = TaxBrain(start_year, end_year, microdata="CPS", reform=reform_url,

behavior={"sub": 0.25})

tb_dynamic.run()

---------------------------------------------------------------------------

KeyboardInterrupt Traceback (most recent call last)

Cell In[9], line 3

1 tb_dynamic = TaxBrain(start_year, end_year, microdata="CPS", reform=reform_url,

2 behavior={"sub": 0.25})

----> 3 tb_dynamic.run()

File ~/work/Tax-Brain/Tax-Brain/taxbrain/taxbrain.py:178, in TaxBrain.run(self, varlist, client, num_workers)

176 if self.verbose:

177 print("Running dynamic simulations")

--> 178 self._dynamic_run(

179 varlist, base_calc, reform_calc, client, num_workers

180 )

181 else:

182 if self.verbose:

File ~/work/Tax-Brain/Tax-Brain/taxbrain/taxbrain.py:484, in TaxBrain._dynamic_run(self, varlist, base_calc, reform_calc, client, num_workers)

479 lazy_values = []

480 for yr in range(self.start_year, self.end_year + 1):

481 lazy_values.extend(

482 [

483 delayed(

--> 484 self._behresp_advance(

485 base_calc, reform_calc, varlist, yr

486 )

487 )

488 ]

489 )

490 if client:

491 futures = client.compute(lazy_values, num_workers=num_workers)

File ~/work/Tax-Brain/Tax-Brain/taxbrain/taxbrain.py:424, in TaxBrain._behresp_advance(self, base_calc, reform_calc, varlist, year)

416 if self.corp_revenue is not None:

417 reform_calc = dist_corp(

418 reform_calc,

419 self.corp_revenue,

(...) 422 self.ci_params,

423 )

--> 424 base, reform = behresp.response(

425 base_calc, reform_calc, self.params["behavior"], dump=True

426 )

427 base_df = base[varlist]

428 reform_df = reform[varlist]

File /usr/share/miniconda/envs/taxbrain-dev/lib/python3.13/site-packages/behresp/behavior.py:225, in response(calc_1, calc_2, elasticities, dump)

223 del calc1

224 # Add behavioral-response changes to income sources

--> 225 calc2_behv = copy.deepcopy(calc2)

226 del calc2

227 if not zero_sub_and_inc:

File /usr/share/miniconda/envs/taxbrain-dev/lib/python3.13/copy.py:163, in deepcopy(x, memo, _nil)

161 y = x

162 else:

--> 163 y = _reconstruct(x, memo, *rv)

165 # If is its own copy, don't memoize.

166 if y is not x:

File /usr/share/miniconda/envs/taxbrain-dev/lib/python3.13/copy.py:260, in _reconstruct(x, memo, func, args, state, listiter, dictiter, deepcopy)

258 if state is not None:

259 if deep:

--> 260 state = deepcopy(state, memo)

261 if hasattr(y, '__setstate__'):

262 y.__setstate__(state)

File /usr/share/miniconda/envs/taxbrain-dev/lib/python3.13/copy.py:137, in deepcopy(x, memo, _nil)

135 copier = _deepcopy_dispatch.get(cls)

136 if copier is not None:

--> 137 y = copier(x, memo)

138 else:

139 if issubclass(cls, type):

File /usr/share/miniconda/envs/taxbrain-dev/lib/python3.13/copy.py:222, in _deepcopy_dict(x, memo, deepcopy)

220 memo[id(x)] = y

221 for key, value in x.items():

--> 222 y[deepcopy(key, memo)] = deepcopy(value, memo)

223 return y

File /usr/share/miniconda/envs/taxbrain-dev/lib/python3.13/copy.py:163, in deepcopy(x, memo, _nil)

161 y = x

162 else:

--> 163 y = _reconstruct(x, memo, *rv)

165 # If is its own copy, don't memoize.

166 if y is not x:

File /usr/share/miniconda/envs/taxbrain-dev/lib/python3.13/copy.py:260, in _reconstruct(x, memo, func, args, state, listiter, dictiter, deepcopy)

258 if state is not None:

259 if deep:

--> 260 state = deepcopy(state, memo)

261 if hasattr(y, '__setstate__'):

262 y.__setstate__(state)

File /usr/share/miniconda/envs/taxbrain-dev/lib/python3.13/copy.py:137, in deepcopy(x, memo, _nil)

135 copier = _deepcopy_dispatch.get(cls)

136 if copier is not None:

--> 137 y = copier(x, memo)

138 else:

139 if issubclass(cls, type):

File /usr/share/miniconda/envs/taxbrain-dev/lib/python3.13/copy.py:222, in _deepcopy_dict(x, memo, deepcopy)

220 memo[id(x)] = y

221 for key, value in x.items():

--> 222 y[deepcopy(key, memo)] = deepcopy(value, memo)

223 return y

File /usr/share/miniconda/envs/taxbrain-dev/lib/python3.13/copy.py:163, in deepcopy(x, memo, _nil)

161 y = x

162 else:

--> 163 y = _reconstruct(x, memo, *rv)

165 # If is its own copy, don't memoize.

166 if y is not x:

File /usr/share/miniconda/envs/taxbrain-dev/lib/python3.13/copy.py:260, in _reconstruct(x, memo, func, args, state, listiter, dictiter, deepcopy)

258 if state is not None:

259 if deep:

--> 260 state = deepcopy(state, memo)

261 if hasattr(y, '__setstate__'):

262 y.__setstate__(state)

File /usr/share/miniconda/envs/taxbrain-dev/lib/python3.13/copy.py:137, in deepcopy(x, memo, _nil)

135 copier = _deepcopy_dispatch.get(cls)

136 if copier is not None:

--> 137 y = copier(x, memo)

138 else:

139 if issubclass(cls, type):

File /usr/share/miniconda/envs/taxbrain-dev/lib/python3.13/copy.py:202, in _deepcopy_tuple(x, memo, deepcopy)

201 def _deepcopy_tuple(x, memo, deepcopy=deepcopy):

--> 202 y = [deepcopy(a, memo) for a in x]

203 # We're not going to put the tuple in the memo, but it's still important we

204 # check for it, in case the tuple contains recursive mutable structures.

205 try:

File /usr/share/miniconda/envs/taxbrain-dev/lib/python3.13/copy.py:137, in deepcopy(x, memo, _nil)

135 copier = _deepcopy_dispatch.get(cls)

136 if copier is not None:

--> 137 y = copier(x, memo)

138 else:

139 if issubclass(cls, type):

File /usr/share/miniconda/envs/taxbrain-dev/lib/python3.13/copy.py:222, in _deepcopy_dict(x, memo, deepcopy)

220 memo[id(x)] = y

221 for key, value in x.items():

--> 222 y[deepcopy(key, memo)] = deepcopy(value, memo)

223 return y

File /usr/share/miniconda/envs/taxbrain-dev/lib/python3.13/copy.py:137, in deepcopy(x, memo, _nil)

135 copier = _deepcopy_dispatch.get(cls)

136 if copier is not None:

--> 137 y = copier(x, memo)

138 else:

139 if issubclass(cls, type):

File /usr/share/miniconda/envs/taxbrain-dev/lib/python3.13/copy.py:222, in _deepcopy_dict(x, memo, deepcopy)

220 memo[id(x)] = y

221 for key, value in x.items():

--> 222 y[deepcopy(key, memo)] = deepcopy(value, memo)

223 return y

File /usr/share/miniconda/envs/taxbrain-dev/lib/python3.13/copy.py:163, in deepcopy(x, memo, _nil)

161 y = x

162 else:

--> 163 y = _reconstruct(x, memo, *rv)

165 # If is its own copy, don't memoize.

166 if y is not x:

File /usr/share/miniconda/envs/taxbrain-dev/lib/python3.13/copy.py:260, in _reconstruct(x, memo, func, args, state, listiter, dictiter, deepcopy)

258 if state is not None:

259 if deep:

--> 260 state = deepcopy(state, memo)

261 if hasattr(y, '__setstate__'):

262 y.__setstate__(state)

[... skipping similar frames: _deepcopy_dict at line 222 (2 times), deepcopy at line 137 (2 times)]

File /usr/share/miniconda/envs/taxbrain-dev/lib/python3.13/copy.py:163, in deepcopy(x, memo, _nil)

161 y = x

162 else:

--> 163 y = _reconstruct(x, memo, *rv)

165 # If is its own copy, don't memoize.

166 if y is not x:

File /usr/share/miniconda/envs/taxbrain-dev/lib/python3.13/copy.py:260, in _reconstruct(x, memo, func, args, state, listiter, dictiter, deepcopy)

258 if state is not None:

259 if deep:

--> 260 state = deepcopy(state, memo)

261 if hasattr(y, '__setstate__'):

262 y.__setstate__(state)

File /usr/share/miniconda/envs/taxbrain-dev/lib/python3.13/copy.py:137, in deepcopy(x, memo, _nil)

135 copier = _deepcopy_dispatch.get(cls)

136 if copier is not None:

--> 137 y = copier(x, memo)

138 else:

139 if issubclass(cls, type):

File /usr/share/miniconda/envs/taxbrain-dev/lib/python3.13/copy.py:222, in _deepcopy_dict(x, memo, deepcopy)

220 memo[id(x)] = y

221 for key, value in x.items():

--> 222 y[deepcopy(key, memo)] = deepcopy(value, memo)

223 return y

File /usr/share/miniconda/envs/taxbrain-dev/lib/python3.13/copy.py:163, in deepcopy(x, memo, _nil)

161 y = x

162 else:

--> 163 y = _reconstruct(x, memo, *rv)

165 # If is its own copy, don't memoize.

166 if y is not x:

File /usr/share/miniconda/envs/taxbrain-dev/lib/python3.13/copy.py:254, in _reconstruct(x, memo, func, args, state, listiter, dictiter, deepcopy)

252 if deep and args:

253 args = (deepcopy(arg, memo) for arg in args)

--> 254 y = func(*args)

255 if deep:

256 memo[id(x)] = y

File /usr/share/miniconda/envs/taxbrain-dev/lib/python3.13/copy.py:253, in <genexpr>(.0)

251 deep = memo is not None

252 if deep and args:

--> 253 args = (deepcopy(arg, memo) for arg in args)

254 y = func(*args)

255 if deep:

File /usr/share/miniconda/envs/taxbrain-dev/lib/python3.13/copy.py:135, in deepcopy(x, memo, _nil)

131 return y

133 cls = type(x)

--> 135 copier = _deepcopy_dispatch.get(cls)

136 if copier is not None:

137 y = copier(x, memo)

KeyboardInterrupt:

Once that finishes running, we can produce the same weighted total table as we did with the static run.

print("Partial Equilibrium - Combined Tax Liability")

tb_dynamic.weighted_totals("combined")

Partial Equilibrium - Combined Tax Liability

| 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Base | 2.269727e+12 | 3.067767e+12 | 3.246623e+12 | 3.395728e+12 | 3.575938e+12 | 3.979716e+12 | 4.161639e+12 | 4.344151e+12 | 4.543397e+12 | 4.749701e+12 |

| Reform | 2.307804e+12 | 3.119395e+12 | 3.312243e+12 | 3.476774e+12 | 3.673491e+12 | 4.082934e+12 | 4.282357e+12 | 4.483171e+12 | 4.690507e+12 | 4.904587e+12 |

| Difference | 3.807725e+10 | 5.162814e+10 | 6.561941e+10 | 8.104634e+10 | 9.755272e+10 | 1.032176e+11 | 1.207186e+11 | 1.390202e+11 | 1.471100e+11 | 1.548863e+11 |

Or we can produce a distribution table to see details on the effects of the reform.

print("Distribution Table")

tb_dynamic.distribution_table(start_year, "weighted_deciles", "expanded_income", "reform")

Distribution Table

| count | c00100 | count_StandardDed | standard | count_ItemDed | c04470 | c04600 | c04800 | taxbc | c62100 | ... | othertaxes | refund | iitax | payrolltax | combined | ubi | benefit_cost_total | benefit_value_total | expanded_income | aftertax_income | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0-10n | 0.102049 | -7.647952 | 0.018507 | -5.835622 | 0.000000 | 0.000000 | 0.0 | 0.000000 | 0.000000 | -7.764826 | ... | 0.000000 | 0.354646 | -0.354646 | 0.064998 | -0.289648 | 0.0 | 0.799655 | 0.799655 | -6.940854 | -6.651206 |

| 0-10z | 8.391348 | -0.092134 | 8.391348 | 112.514735 | 0.000000 | 0.000000 | 0.0 | 0.000000 | 0.000000 | -0.092134 | ... | 0.000000 | 17.779859 | -17.779859 | 0.000000 | -17.779859 | 0.0 | 0.000000 | 0.000000 | 0.000000 | 17.779859 |

| 0-10p | 12.213289 | 28.286909 | 12.207105 | 167.047672 | 0.006184 | 0.035899 | 0.0 | 0.109175 | 0.003643 | 28.250938 | ... | 0.000000 | 28.404318 | -28.400675 | 3.495389 | -24.905286 | 0.0 | 19.592770 | 19.592770 | 50.389807 | 75.295093 |

| 10-20 | 20.707972 | 207.041657 | 20.230779 | 280.157298 | 0.472337 | 7.619006 | 0.0 | 25.986559 | 2.401345 | 200.049307 | ... | 0.000000 | 68.924569 | -66.523628 | 27.626076 | -38.897552 | 0.0 | 107.290602 | 107.290602 | 323.220845 | 362.118396 |

| 20-30 | 20.707385 | 316.378323 | 19.648591 | 287.017567 | 1.053396 | 18.740597 | 0.0 | 116.225685 | 11.584224 | 299.238036 | ... | 0.000000 | 67.787144 | -56.195886 | 43.577393 | -12.618493 | 0.0 | 258.441980 | 258.441980 | 590.805721 | 603.424214 |

| 30-40 | 20.707088 | 392.642544 | 19.510973 | 297.416383 | 1.187950 | 22.114507 | 0.0 | 184.988094 | 19.315954 | 371.147034 | ... | 0.000000 | 67.101813 | -47.772787 | 53.603619 | 5.830832 | 0.0 | 369.313918 | 369.313918 | 787.711190 | 781.880357 |

| 40-50 | 20.708472 | 550.480439 | 19.029242 | 307.522806 | 1.676905 | 33.455448 | 0.0 | 286.992712 | 30.516102 | 519.344714 | ... | 0.000000 | 78.292375 | -47.767104 | 72.879144 | 25.112041 | 0.0 | 404.535394 | 404.535394 | 994.589197 | 969.477157 |

| 50-60 | 20.707393 | 735.630028 | 18.331876 | 326.411031 | 2.373124 | 49.426182 | 0.0 | 425.521954 | 47.073700 | 691.665427 | ... | 0.000000 | 93.114874 | -46.034925 | 95.833407 | 49.798482 | 0.0 | 466.945896 | 466.945896 | 1258.080439 | 1208.281958 |

| 60-70 | 20.707515 | 959.511949 | 17.811997 | 357.787922 | 2.893239 | 62.644720 | 0.0 | 606.027111 | 72.245168 | 905.890709 | ... | 0.000000 | 112.380798 | -40.126138 | 122.146512 | 82.020374 | 0.0 | 578.376040 | 578.376040 | 1603.049167 | 1521.028793 |

| 70-80 | 20.707197 | 1365.708941 | 16.719155 | 373.852288 | 3.982463 | 98.050853 | 0.0 | 941.858952 | 119.044547 | 1288.034856 | ... | 0.000000 | 121.724695 | -2.658703 | 172.536431 | 169.877728 | 0.0 | 634.000703 | 634.000703 | 2085.339711 | 1915.461983 |

| 80-90 | 20.707626 | 2093.482677 | 14.553142 | 349.813909 | 6.152092 | 179.989249 | 0.0 | 1578.829459 | 218.697073 | 1951.769562 | ... | 0.004426 | 125.344051 | 93.372100 | 257.189635 | 350.561734 | 0.0 | 640.771616 | 640.771616 | 2872.252958 | 2521.691223 |

| 90-100 | 20.708041 | 6246.236344 | 9.453390 | 234.654561 | 11.254651 | 386.830268 | 0.0 | 5608.201771 | 1197.758029 | 5942.795098 | ... | 13.805670 | 47.686797 | 1165.232430 | 553.861208 | 1719.093638 | 0.0 | 512.904614 | 512.904614 | 6987.435086 | 5268.341448 |

| ALL | 207.075375 | 12887.659726 | 175.906106 | 3088.360551 | 31.052341 | 858.906729 | 0.0 | 9774.741472 | 1718.639786 | 12190.328720 | ... | 13.810095 | 828.895941 | 904.990179 | 1402.813813 | 2307.803992 | 0.0 | 3992.973188 | 3992.973188 | 17545.933268 | 15238.129276 |

| 90-95 | 10.353704 | 1667.324398 | 5.676570 | 140.884353 | 4.677134 | 148.216845 | 0.0 | 1374.670598 | 220.454555 | 1553.995778 | ... | 0.030698 | 34.014434 | 186.471142 | 189.172816 | 375.643958 | 0.0 | 284.797859 | 284.797859 | 2039.255590 | 1663.611631 |

| 95-99 | 8.283571 | 2341.021395 | 3.296412 | 82.219564 | 4.987159 | 170.622619 | 0.0 | 2075.284086 | 397.064195 | 2203.591113 | ... | 1.300444 | 13.626819 | 384.737819 | 212.266995 | 597.004815 | 0.0 | 192.019886 | 192.019886 | 2627.393087 | 2030.388273 |

| Top 1% | 2.070766 | 2237.890550 | 0.480409 | 11.550644 | 1.590357 | 67.990803 | 0.0 | 2158.247087 | 580.239279 | 2185.208206 | ... | 12.474527 | 0.045543 | 594.023468 | 152.421397 | 746.444865 | 0.0 | 36.086868 | 36.086868 | 2320.786409 | 1574.341544 |

16 rows × 24 columns

Dynamic Reform with Corporate Income Tax Incidence#

Now we simulate a dynamic revenue estimate while accounting for the incidence of a corporate income tax change.

# Corporate revenue estimate

corp_rev = [5_000_000_000] * (end_year - start_year + 1)

incidence_assumptions = {

"Incidence": { # long-run incidence of corporate tax

"Labor share": 0.5,

"Shareholder share": 0.4,

"All capital share": 0.1,

},

"Long run years": 10, # number of years to reach long-run incidence

}

tb_dynamic = TaxBrain(start_year, end_year, microdata="CPS", reform=reform_url,

behavior={"sub": 0.25},

corp_revenue=corp_rev,

corp_incidence_assumptions=incidence_assumptions)

tb_dynamic.run()

print("Partial Equilibrium - Combined Tax Liability")

tb_dynamic.weighted_totals("combined")

Partial Equilibrium - Combined Tax Liability

| 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Base | 2.269727e+12 | 3.067767e+12 | 3.246623e+12 | 3.395728e+12 | 3.575938e+12 | 3.979716e+12 | 4.161639e+12 | 4.344151e+12 | 4.543397e+12 | 4.749701e+12 |

| Reform | 2.309448e+12 | 3.121009e+12 | 3.313788e+12 | 3.478349e+12 | 3.675071e+12 | 4.084663e+12 | 4.284063e+12 | 4.484873e+12 | 4.692225e+12 | 4.906309e+12 |

| Difference | 3.972134e+10 | 5.324191e+10 | 6.716455e+10 | 8.262134e+10 | 9.913307e+10 | 1.049468e+11 | 1.224239e+11 | 1.407223e+11 | 1.488282e+11 | 1.566081e+11 |